P.F. Chang’s is taking another stab at the fast-casual market, this time with an Asian bowl concept called Pagoda by P.F. Chang’s.

An in-line unit of that name has opened in Woodbury Common Premier Outlets, an upscale outdoor shopping mall in the suburbs north of New York City. The restaurant features a Chipotle-like production line where staff members build the meal to customers’ specifications.

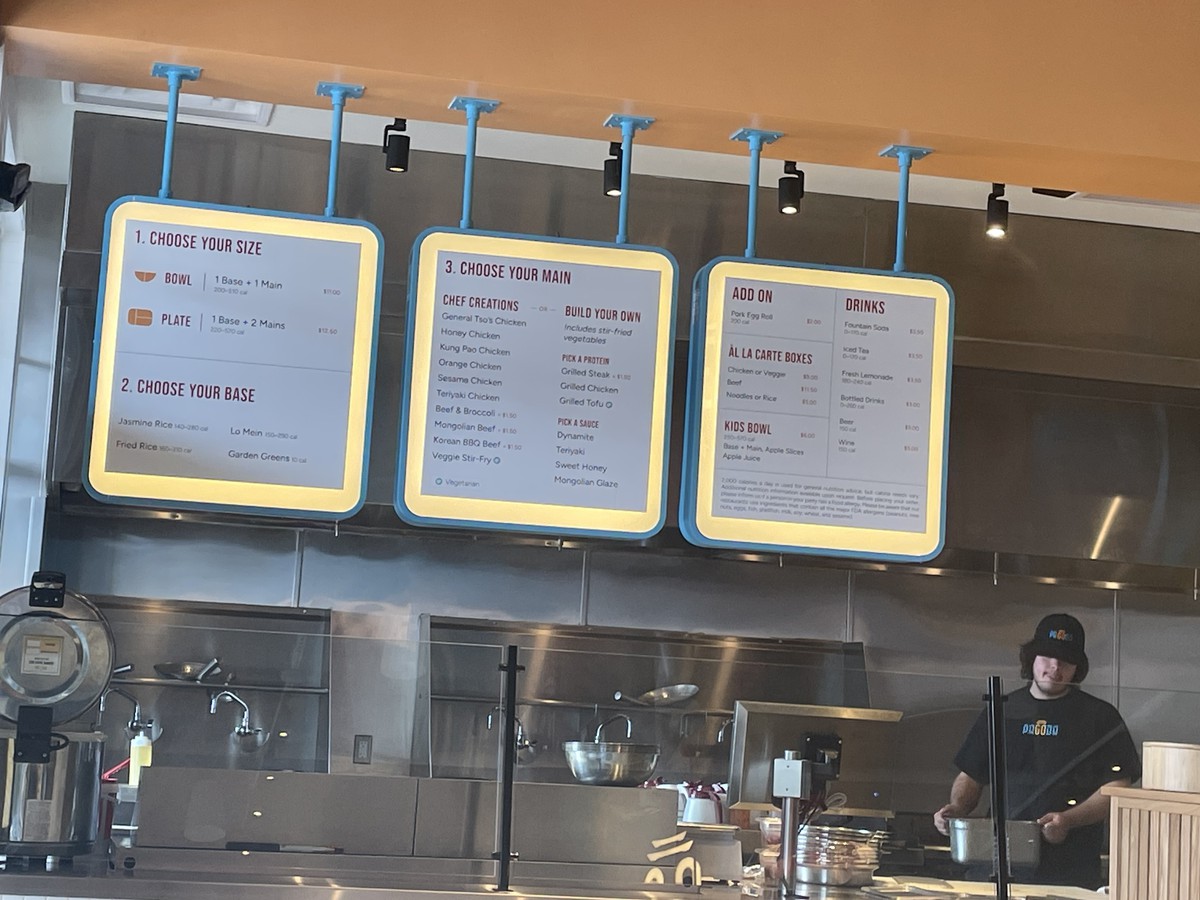

Pagoda has a Chipotle-like ordering process. | Photos by Peter Romeo

At the start of the line, patrons specify whether they want a bowl or a plate. Either way, they have a choice of what will serve as the base of their meal: jasmine rice, fried rice, lo mein or garden greens.

Patrons then choose one or more proteins or vegetable add-ons to top the base. They can specify one of 10 Chef Creations, all of them familiar Asian preparations. The options range from General Tso’s Chicken to Mongolian Beef. The lone nonmeat choice is the Veggie Stir Fry.

There’s also a Build Your Own option where the selections for the second layer range from stir-fry vegetables to grilled steak, chicken or tofu. Guests can then top the mixture with a teriyaki or honey sauce, or the Mongolian Glaze.

Egg rolls are offered as an add-on.

The beverage selections include fresh lemonade ($3.50), beer and wine (both $5).

A bowl or plate with one topping is priced at $11, and base with two goes for $12.50.

At the full-scale P.F. Chang’s closest to Woodbury, a to-go order of Mongolian Beef big enough to serve two sells for $28.50, and a similar sized order of vegetable lo mein is priced at $18.

Bowls range in price from $11 to $12.50.

Chang’s executives declined to be interviewed about the venture, which had been months in the making.

The upscale casual chain has launched at least two earlier fast-casual ventures. In 2000, the brand hatched a smaller-scale, limited-service venture called Pei Wei Diner, whose name was later changed to Pei Wei Kitchen. It featured many of the same selections offered by a P.F. Chang’s, but at lower prices.

Chang’s spun off the venture into a free-standing company in 2017, saying it wanted to focus on its core business of full-service restaurants. Pei Wei had about 200 stores at the time, and now has about 120.

In late 2020, after Chang’s had been acquired for $700 million by a partnership of the investment firms TriArtisan Capital Advisors and J.Paulson, the Chinese chain opened a scaled-down takeout and delivery outlet called P.F. Chang’s To Go.

The company said at the time that To Go would be developed in densely populated urban areas like New York City and Washington, D.C. It also acknowledged that its expansion plans for the venture were ambitious.

But the company eventually backed away from that commitment. Then-CEO Damola Adamolekun explained at a Restaurant Business event that the development emphasis was shifting back to full-scale P.F. Chang’s Chinese Bistros because the large properties could house three distinct revenue providers in a single real estate investment: dine-in service, delivery and takeout.

Adamolekun left the company in August 2023, and the CEO’s post was filled in October by Eduardo Luz, formerly chief brand and concept officer for Panera Bread.

Chang’s 223 U.S. restaurants generated systemwide sales last year of $994.3 million, according to Technomic’s Top 500 sales ranking.

Members help make our journalism possible. Become a Restaurant Business member today and unlock exclusive benefits, including unlimited access to all of our content. Sign up here.